Insider Brief

- Summize raised $50 million to accelerate global expansion and product development for its AI-driven contract lifecycle management platform, with participation from existing backers Maven Capital Partners and YFM Equity Partners, alongside new investors Kennet Partners and Federated Hermes Private Equity.

- The Manchester-based company reported five consecutive years of more than 100% ARR growth, nearly doubling bookings and ARR year over year in the second half of 2025, while expanding operations in the U.S. and U.K. to support rising enterprise demand.

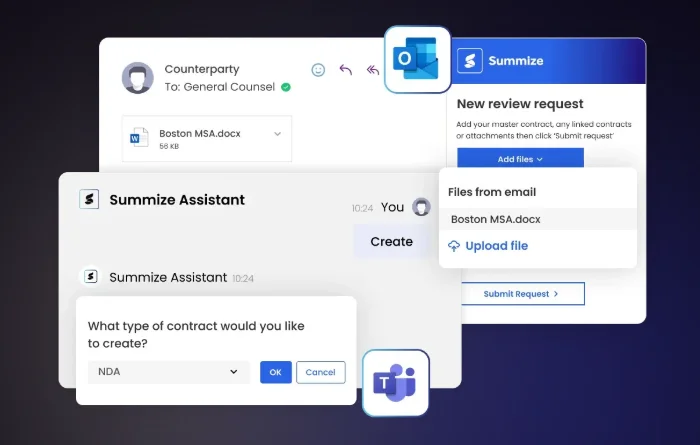

- Summize focuses on embedding AI-powered contract intelligence directly into tools such as Microsoft Word, Outlook, Teams, Slack, and Salesforce, positioning itself as an efficiency layer for legal and business teams rather than a standalone CLM system.

PRESS RELEASE — Summize, a leader in AI Contract Lifecycle Management (CLM) software, today announced it has secured a $50 million investment to accelerate its next phase of growth. The new investment included participation from existing investors, Maven Capital Partners and YFM Equity Partners, and welcomed new specialist tech investment firm Kennet Partners and global investor, Federated Hermes Private Equity. The funding will enable further expansion of its product capabilities, team, and customers globally.

The new funding follows five consecutive years of more than 100% ARR growth as the company has scaled globally. In the last six months, from July to December 2025, Summize grew its customer bookings by 92% and increased its ARR by 97% YoY for the same period. The company also expanded its U.S. footprint with a new office in San Diego, announced in late 2025 to support its West Coast customer base, and a new, larger U.K. office in Manchester to support its global team headcount growth of 59% in the past year. Customers benefiting from Summize include Revolut, AMC Networks, SHL Medical, Clearscore, Sigma, Matillion, and Groq, as well as numerous U.S. professional sports teams in the NBA, MLB, and NFL.

“Summize’s proven performance, clear market differentiation, and long-term vision for AI-powered contract management make it a disruptive CLM player in a crowded market,” said Alex Taylor-Harris, Director at Kennet Partners. “Summize has an incredible track record of consistent growth as customers love its embedded approach and ability to bring the power of AI and CLM directly into the tools that they already use on a daily basis.”

Summize helps in-house legal teams manage contracts within popular software applications, including Microsoft Word, Outlook, Microsoft Teams, Slack, Salesforce, and HubSpot, enabling maximum efficiency, accuracy, and speed. Built on its CLM platform and using agentic AI, Summize applies legal context to ensure accuracy and trust in the contracting process. Summize also leverages AI to extract insights and knowledge from financial documents, compliance materials, handbooks, and regulatory content, surfacing important information in the right tools at the right time.

Jeremy Thompson, Partner at Maven Capital, said, “The Summize approach to innovation, its strong leadership team, and impressive company culture make it a strong investment. From its roots in summarizing contracts, the company has expanded its capabilities rapidly to become a cutting-edge Contract Lifecycle Management solution that has attracted global clients. With an exciting roadmap and big, future ideas, we’re looking forward to the next phase of growth and continued success with Summize.”

Mike Clarke, Partner at YFM Equity, added, “The Summize AI-powered experience offers a sophisticated approach to contracting that legal teams are easily adopting and using daily. Customers experience an incredible ROI in a short amount of time and benefit from the embedded experience of Summize within their existing collaboration tools. In addition, Summize’s strong foundation in AI and its ability to contextualize knowledge are designed to scale beyond core CLM use cases and into other areas of a company’s business, making this a strategic AI investment that scales beyond legal.”

Tom Dunlop, CEO and Co-Founder of Summize, said, “We founded Summize to make contracts easier to understand and the contracting process more efficient by complementing how modern teams work. This new $50 million investment underlines our differentiated user experience and ability to design innovative, trusted AI solutions for legal teams and the wider business. With the support of our new and existing investors, we will continue to scale the business by focusing on our intuitive user experience, ongoing AI innovation, and expanding our exceptional team to support our growing number of global customers.”

Summize engaged Canaccord Genuity as exclusive financial advisor to the company and its shareholders on the transaction, Squire Patton Boggs as legal advisor and BDO to provide finance and tax advice.