Insider Brief

- Faraday Future secured $30 million in financing commitments to accelerate the development of its affordable, high-performance AI-equipped electric vehicles (Faraday X) and support corporate growth.

- The funds, structured as convertible notes and warrants, will facilitate prototype development, testing at its Hanford facility, and strategic expansion in the U.S. mainstream EV market.

- Faraday Future aims to redefine the EV industry with advanced in-car AI technology, starting with the delivery and testing of its first FX prototypes in early 2025.

PRESS RELEASE — Faraday Future Intelligent Electric Inc. (Nasdaq: FFIE) (“FF”, “Faraday Future”, or “Company”), a California-based technology company specializing in artificial intelligence electric vehicles (AIEV), announced that it has secured approximately $30 million in cash financing commitments. The funds will be used to accelerate the Company’s growth and the development of Faraday X (FX), FF’s strategy of launching affordable high performance AIEV equipped vehicles with cutting edge technology, filling the U.S. market gap in this segment, and for general corporate purposes.

Targeting the mainstream EV market in the U.S., FF is expected to have its first two FX prototype mules arrive in Los Angeles later this month, with product development and testing scheduled to begin at FF’s manufacturing facility in Hanford, CA. As part of their delivery journey, the two prototype mules will stop in Las Vegas from January 5 to 7, 2025, where the Company will provide updates on its FX strategy.

The $30 million financing commitment includes a pre-funded $7.5 million, which was received in the fourth quarter of this year, and $22.5 million in new cash commitments (the “Financing”), structured in the form of unsecured convertible notes (“Convertible Notes”) and warrants to acquire additional shares of the Company’s common stock (“Warrants”). The conversion price for the Convertible Notes and exercise price for the Warrants are $1.16 and $1.392 per share, respectively, subject to adjustment as set forth therein. The shares of common stock underlying the Convertible Notes and Warrants issued in the Financing are currently unregistered, subject to trading restrictions, and not immediately tradable. The Financing is subject to customary closing conditions. For additional information regarding the material terms relating to the Financing, please see the Company’s Form 8-K to be filed with the SEC on December 23, 2024.

“The new funding lays a solid foundation for both FF and its new brand as the Company approaches the end of 2024 and enters the new year,” said Matthias Aydt, Global CEO of FF “I am optimistic about the opportunities that this new funding will bring, including supporting the ongoing production of our FF 91 2.0 and the growth of the FX brand,” Aydt explained.

“We are pleased to have supported FF in successfully completing this round of financing,” said Jerry Wang, President of FF Global Partners and Head of Corporate Development, FFIE (Consultant), “We are enthusiastic about the promising opportunities ahead for the FX brand, and we firmly believe in FF’s ability to execute its strategy effectively and deliver significant value in the process.”

The Convertible Notes, along with the Warrants, were offered and sold in a transaction exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D of the Securities Act and in reliance on similar exemptions under applicable state laws.

Accordingly, the Convertible Notes, Warrants and underlying shares of common stock issuable upon conversion of the Convertible Notes and exercise of the Warrants may not be offered or sold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities laws.

The Company has agreed to file one or more registration statements with the Securities and Exchange Commission registering the resale of the shares of common stock issuable upon conversion of the Convertible Notes and exercise of the Warrants issued in connection with the Financing.

This press release does not constitute an offer to sell or the solicitation of an offer to buy the convertible notes, nor shall it constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

ABOUT FARADAY FUTURE

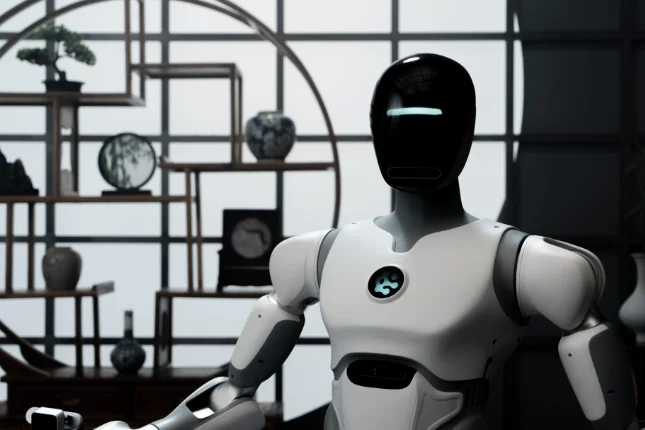

Faraday Future is the pioneer of the Ultimate AI TechLuxury market amidst the global trend of EVs. Luxury is just one of the key factors reflecting FF’s achievements in reshaping the EV industry. The company is dedicated to establishing an ever-evolving, interactive in-car software and operating system powered by artificial intelligence and user-generated data, optimizing the experience for each individual within an ecosystem of worldwide users who are also contributors to the innovative FF model.

Contacts

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com