Insider Brief

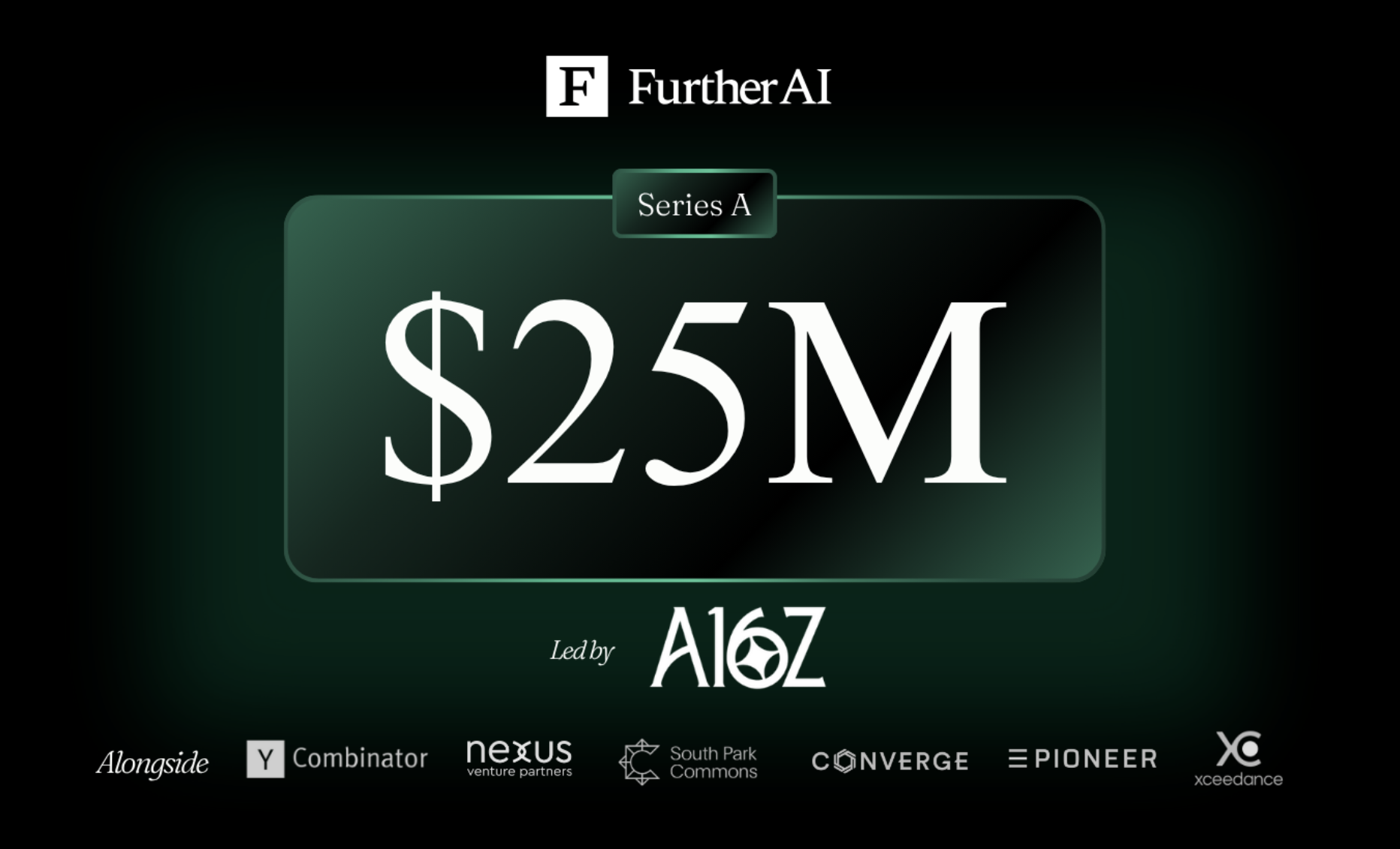

- FurtherAI raised $25 million in Series A funding led by Andreessen Horowitz, just six months after a $5 million seed round, bringing total funding to $30 million.

- The company’s AI-native platform automates insurance workflows — such as underwriting, claims handling, and policy comparisons — improving accuracy, speed, and productivity for major insurers like Accelerant and Leavitt Group.

- By replacing outdated tools with domain-specific AI, FurtherAI is enabling insurance teams to double efficiency, reduce costs, and modernize operations across the industry.

PRESS RELEASE — The people who keep insurance running are overwhelmed. They’re doing trillion-dollar work with outdated tools — buried in PDFs and Excels, juggling manual reviews, and navigating disconnected systems. FurtherAI, the leading AI for insurance, is changing that. The company has announced a $25 million Series A led by Andreessen Horowitz — one of the largest Series A ever raised in insurance AI.

The raise comes just six months after its $5M seed round, underscoring the industry’s rapid embrace of domain-specific AI. The round also included Nexus Venture Partners, Y Combinator, amongst others bringing their total funding to $30 million.

With this new funding, FurtherAI will expand its library of insurance-specific workflows, deepen integrations with carrier and broker systems, and scale its go to market teams to meet surging demand. The goal is simple: help insurers with its long awaited technology transformation by automating workflows like submissions processing, underwriting audits, claims handling, and policy comparisons through AI so professionals can focus on risk, clients, and growth.

Insurance is under pressure on every front — talent is scarce, climate risk is rising, and regulators demand more transparency. Many insurers have already experimented with AI, but the results fall short: generic tools miss the nuances of complex insurance documents, while point solutions only solve a slice of the problem. FurtherAI offers a third path — an insurance-native workspace that lets insurance teams start with one workflow and expand across many, all while ensuring accuracy, auditability, and scale.

“We’re grateful to partner with leaders across the industry as they modernize operations,” said Aman Gour, Co-Founder and CEO of FurtherAI. “Insurance is the backbone of the economy, but the people running it have been stuck with outdated tools. With this funding, we’re doubling down on building AI workflows that give underwriters, brokers, and claims teams superpowers — freeing them to focus on the work that truly matters.”

Today, FurtherAI processes billions in premiums each year — powering submissions, policy comparisons, claims intake, and compliance checks for leading insurers like Accelerant, MSI, and Leavitt Group.

“We’re excited to partner with the insurance industry to unlock real value with AI — automating the busy work and opening new avenues of growth. With our forward-deployed engineering model, insurance teams work side-by-side with an AI engineer to ensure impact at scale.” said Sashank Gondala, Co-Founder and CTO of FurtherAI.

The impact is clear: teams are doubling productivity, improving submission-to-quote ratios by 15%, reaching over 95% accuracy in policy comparisons, and generating proposals 10x faster.

Industry leaders are seeing the results firsthand. “The FurtherAI team has been a fantastic partner in rapidly standing up complex enterprise workflows,” said Venkat Raman, Chief BizOps Officer at Accelerant. While Laurie Flanagan of Leavitt Group summed it up: “Implementing FurtherAI has been game-changing — faster turnarounds, higher accuracy, and a platform we can keep expanding.”

This raise cements FurtherAI as the AI workspace powering the future of insurance. “FurtherAI is redefining how insurance gets done,” said Joe Schmidt, Partner at Andreessen Horowitz. “Aman and Sashank are technical founders whose customers see them as true AI partners, not just AI tools. Their early traction signals a generational opportunity to transform insurance.”

About FurtherAI

FurtherAI is the AI workspace purpose-built for insurance. By automating submission intake, policy comparison, claims processing, and compliance workflows, FurtherAI eliminates busywork so insurance professionals can focus on strategy and growth. Founded in San Francisco, FurtherAI is backed by Andreessen Horowitz, Nexus Venture Partners, Y Combinator, and other leading investors. For more information, visit www.furtherai.com.

About Andreessen Horowitz

Andreessen Horowitz (a16z) is a venture capital firm that backs bold entrepreneurs building the future through technology. a16z invests in seed to venture to growth-stage technology companies, across AI, bio + healthcare, consumer, crypto, enterprise, fintech, games, infrastructure, and companies building toward American dynamism. Founded in Silicon Valley in 2009, a16z has $46B in committed capital across multiple funds.