Insider Brief

- Experts disagree about the economic impact of AI.

- AI is expected to significantly impact productivity and global GDP, others say those numbers don’t add up.

- Here we’ll break down two differing positions on AI’s economic impact potential — an MIT economist writing in the Financial Review and Goldman Sachs economists.

The debate over the economic impact of artificial intelligence (AI) has become a contentious issue among experts.

While some project significant gains in productivity and global GDP, others remain skeptical about the near-term benefits and the extent of AI’s transformative power.

Two of these divergent views come from prominent voices in the field — here we’ll look at two: recent analyses by Daron Acemoglu, an economist writing in Financial Review, and a report from Goldman Sachs.

Optimistic Projections: Goldman Sachs’ Perspective

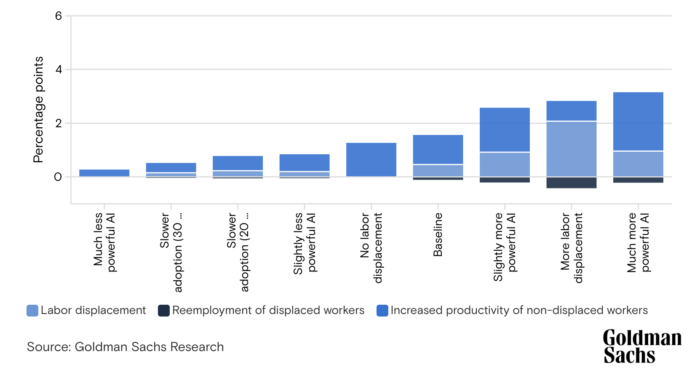

According to Goldman Sachs Research, breakthroughs in generative AI hold the potential to revolutionize the global economy. The firm forecasts that AI could increase global GDP by 7%, or nearly $7 trillion, over the next decade. Productivity growth is expected to rise by 1.5 percentage points annually during this period. These optimistic projections are based on AI’s ability to produce human-like content and enhance communication between humans and machines, which could significantly impact various industries.

Joseph Briggs and Devesh Kodnani, economists at Goldman Sachs, argue that the integration of AI into business processes will streamline workflows and automate routine tasks. They estimate that roughly two-thirds of U.S. occupations could be exposed to some degree of AI-driven automation. However, they emphasize that this does not necessarily equate to mass layoffs. Instead, many jobs will likely be complemented by AI, leading to improved efficiency and new job creation.

The report also highlights historical trends where technological innovations have led to the emergence of new job categories. For instance, information technology advances have given rise to occupations like software developers and digital marketing professionals. A study by economist David Autor, cited in the Goldman Sachs report, found that 60% of today’s jobs did not exist in 1940. This suggests that technological progress can spur significant employment growth over time.

Goldman Sachs economics also foresee substantial impacts on industries such as enterprise software, healthcare and financial services. The integration of AI is expected to enhance productivity, streamline business operations and foster innovation. Companies are already incorporating AI into their product portfolios, potentially driving growth through new product releases, premium pricing for AI-integrated offerings, and higher customer retention.

Skepticism and Caution: Daron Acemoglu’s Analysis

Contrasting the optimism of Goldman Sachs, Daron Acemoglu offers a more cautious view in Financial Review. Acemoglu, Institute Professor of Economics at MIT, acknowledges the potential of AI to automate certain tasks and improve productivity but argues that the overall impact may be less dramatic than some forecasts suggest. He estimates that AI will increase total factor productivity (TFP) by only 0.66% over ten years, translating to an annual growth rate of 0.06%.

Acemoglu’s analysis is grounded in economic theory and empirical studies. He references research by Shakked Noy and Whitney Zhang on the impact of ChatGPT on simple writing tasks, and by Erik Brynjolfsson, Danielle Li, and Lindsey Raymond on AI assistants in customer service. These studies indicate that current generative AI tools yield average labor-cost savings of 27% and overall cost savings of 14.4%. However, Acemoglu argues that expecting much higher savings or a broader scope of automation is unrealistic.

He points out that only about 4.6% of tasks are likely to be automated by AI in the next decade, a figure that aligns with observed effects of other technologies, such as industrial robots in manufacturing. Moreover, many tasks involving manual or social aspects, like accounting or health diagnostics, are still beyond AI’s capabilities.

Acemoglu, who is a co-author (with Simon Johnson) of Power and Progress: Our Thousand-Year Struggle Over Technology and Prosperity, also raises concerns about the broader economic and social implications of AI. While AI’s effects on inequality might be less pronounced than previous automation waves, he sees no evidence that AI will significantly reduce inequality or boost wage growth. Certain demographic groups, particularly white, native-born women, may be more adversely affected by AI-driven changes.

Divergent Outlooks on AI’s Future

Even the experts are far apart in their analysis on how — or if — AI will impact the economy.

Goldman Sachs’ analysis points to a future where AI drives substantial GDP growth, job creation and industry-wide innovation. On the other side, Acemoglu calls for a more measured approach, emphasizing the need for realistic expectations and cautious policy-making.

Here’s where the experts agree. Both sides understand the transformative potential of AI. They also point our the importance of addressing challenges such as job displacement, inequality and the ethical implications of AI deployment.